By John Patton, Product Manager, Christian Care Ministry

If you’re in your 60’s, you are well aware that there are some major changes coming soon in how you will manage your healthcare. With Medicare now on your horizon, there is a fair amount of new information to address.

As a 64-year-old myself, my mailbox fills every week with a myriad of offerings from every healthcare insurance program imaginable and I don’t believe my situation is at all unique. If we’re making the effort to search for the best option, sorting through it all is, to say the least, a challenge.

So where to begin? With all the group seminar invitations, free lunches, and individual agency offerings, it seems there’s no shortage of options. If you're a Medi-Share member, though, you already have an option without having to look outside of your current healthcare choice.

Prior to 2012, we were regularly educating and helping our 64-year-old members in finding ways to supplement their healthcare needs once their eligibility for Medi-Share came to an end. So, to address these members’ needs, CCM launched a sharing program for our own 65 and older members known as Senior Assist by Medi-Share.

As a senior healthcare solution, the creation of the Senior Assist program offered our members the ability to utilize Medicare and yet remain in a Christian sharing program. Over the past seven years, Senior Assist has steadily grown and is now a major contributor to the overall sharing model for Medi-Share. Whether you’re a Senior Assist member or a regular Medi-Share member, all monthly shares contributed go toward meeting the medical needs of the entire membership.

But just how does Senior Assist work?

Our program was designed to work in conjunction with original Medicare; your fellow Medi-Share members share your medical bills after Medicare Parts A and B stop paying. While Medicare A is basically designed to address your hospitalization costs, you must meet the deductible amount for any benefit period ($1,360 for 2019) before any coverages take effect.

Medicare B is designed to address 80 percent of the costs associated with your other medical needs (like physician services, labs, outpatient services, and various other medical needs), and also includes meeting an annual deductible ($185 for 2019).

The balance left after Medicare pays can become significant, especially if you’re retired and living on a fixed income. There is a significant gap in how you’ll meet your medical needs if you depend on Medicare alone. That is why Medicare supplemental plans, which are secondary payers, came into being.

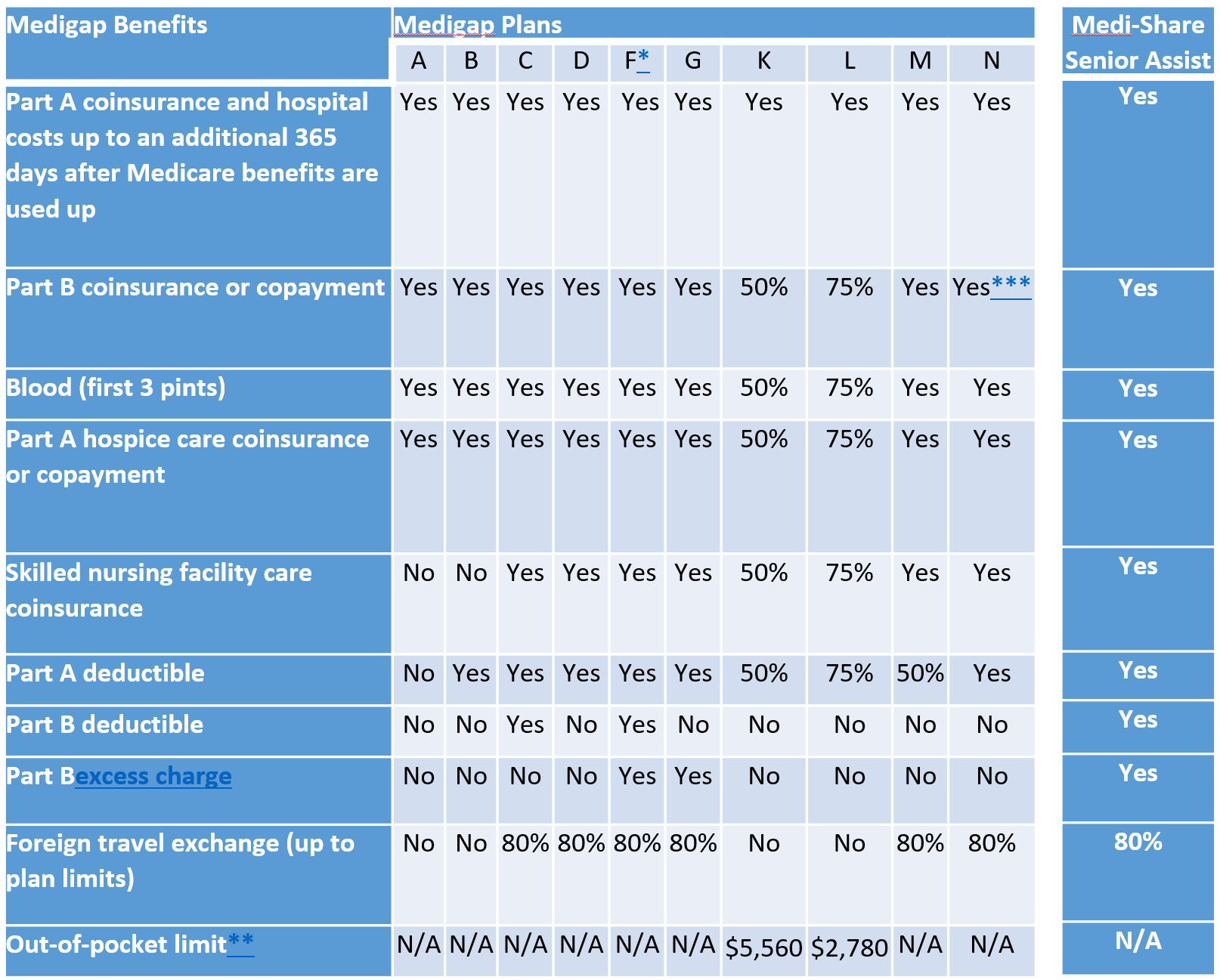

Medicare supplemental plans, commonly referred to as MediGap plans, are offered by private insurance companies, but their varying coverages are regulated by the government at both the federal and state levels. Some supplement plans will range from covering nearly all the costs above what Medicare will pay for, while others will either cover at lower percentages or completely exclude coverage of varying costs. There are many differing MediGap plans with various options. Typically, the higher the cost of your MediGap plan the more comprehensive the coverage options you’ll receive.

Senior Assist is structured to provide sharing at the most comprehensive level, similar to the most comprehensive supplement – the MediGap F plan. The MediGap F plan is also offered in two forms: a no-deductible plan and a high-deductible plan ($2,300 in 2019), the latter offering a much lower monthly premium. The Senior Assist program is similar in most respects to a high deductible MediGap F plan but with an Annual Household Portion (AHP) of only $1,250. The AHP is the member’s responsibility each year toward their medical costs that Medicare A and B do not pay for.

To provide a visual reference of all the MediGap Plan coverages compared to Senior Assist, please review the chart below:

To illustrate how the Medicare process works with Senior Assist, in the simplest of terms, let’s use an example of a $6,500 hospital stay with a $20,000 surgical procedure. For the hospitalization portion of the bill totaling $6,500, the hospital would first send the bill to Medicare. Whatever costs on the bill that are eligible for coverage by Medicare would be paid for, minus the first $1,364, which is the deductible portion of Medicare A.

In this example, Medicare A would pay for $5136. The hospital would receive an Explanation of Benefits document from Medicare detailing the coverage amounts along with a payment of $5136. The hospital would then submit to Senior Assist the Explanation of Benefits (EOB) along with the unpaid portion of the bill of $1,364. Since Senior Assist has an AHP of $1,250, the amount above the AHP ($114) would be shared by the other members and the member would pay the hospital their portion to the hospital. The member has now satisfied their AHP for the year.

Now let’s look at the surgical portion of the bill. The surgeon’s bill is also sent to Medicare. Since this is not a hospitalization bill, it would be processed under Medicare B coverage at only 80 percent, minus the deductible of $185. So, of the original $20,000 the surgeon is trying to collect for services, Medicare will send another EOB along with a payment for $15,815. They will not pay for $4,185 of the bill, which is your 20 percent coinsurance plus the $185 deductible. The surgeon would then send the EOB plus a bill for the remaining balance of $4,185 to Senior Assist. Since you’ve already met your AHP for this year, your eligible bill would then be shared in its entirety.

Ultimately, your $26,500 medical event cost you only $1,250. Understand that this is an oversimplified example of actual medical billing; however, it clearly illustrates the value of your Senior Assist membership.

Many who have chosen to retire will use their leisure time to take advantage of travelling to foreign countries. It’s important to know that Medicare does not cover medical costs outside of the US. However, Senior Assist and supplemental plans will provide in the event there’s a need for emergency or urgent care. MediGap plans will cover urgent care needs at 80 percent with a separate deductible of $250 and a maximum lifetime limit of just $50,000. Senior Assist will also share in emergency care in this instance at 80 percent once your AHP is met, but the lifetime limit is $150,000.

To find the most comprehensive information on how Medicare can work for you, please go to Medicare.gov.

As our members love to share with each other in times of greatest need, it’s good to know that when the time comes to utilize your Medicare benefit, you can continue to take the opportunity to share with and bless your fellow Christians with Senior Assist by Medi-Share.

Comments