By guest financial blogger, Jason Cabler

When it comes to personal finance, the average American family struggles with debt daily. Unfortunately, it’s a problem that most of us seem to believe is inevitable, even necessary, to live a normal life. But while being deep in debt is “normal” for most, it’s definitely not necessary.

The biggest problem that comes with using debt to finance your life is that it makes living life much more expensive. It’s sort of a weird conundrum- most people use debt because they can’t afford to pay cash, but the “affordable” monthly payment ends up costing so much more in the long run. It’s a vicious cycle that keeps too many people trapped and desperate.

“Affordable” Car Payments

For instance, that $20,000 car you financed for 6 years... if you took out a loan at the average interest rate of 4.21%, then financing that car costs you an extra $2,214 over the life of the loan. That $20,000 car is actually a $22,214 car that plummets in value every time you drive it!

“Convenient” Credit Cards

How about credit cards? Even if you pay off your balance every month, studies show that on average, you spend an extra 18% on purchases you make with a credit card vs. using cash.

Unfortunately, the majority of people don’t pay off their balance every month. Therefore, on top of the extra 18%, interest and fees are tacked on, flushing even more hard-earned money down the drain!

Average Household Debt

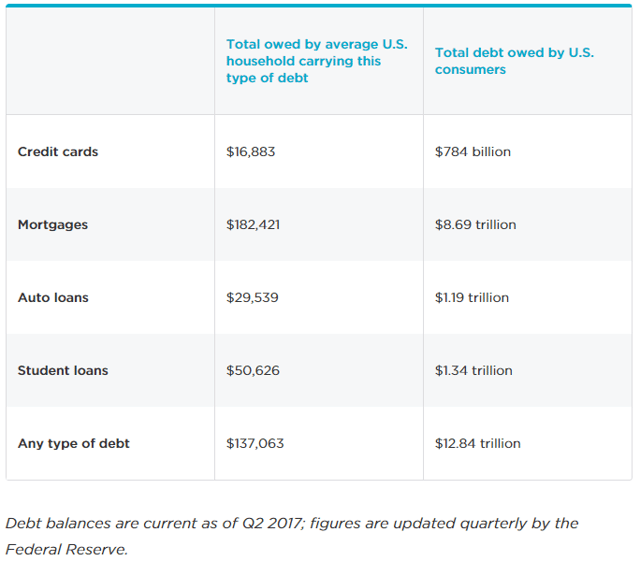

This graphic from NerdWallet shows just how desperate the situation is for the average American:

The Effects of Debt

Whether you finance a washing machine, a Honda, or a college education, you’re spending (wasting) extra money that keeps you in a vicious cycle of debt. This lost money ultimately has a detrimental effect on your quality of life:

- It keeps you poorer

- You have more stress

- Debt negatively affects relationships

- You have less choices in life

- You’re never able to reach your true financial potential.

Obviously, Proverbs 22:7 says it best- “… the borrower is slave to the lender”.

When you’re a slave, you have little or no freedom to live life the way you really want to live it.

How Can You Turn the Tide Financially?

Being in debt is a position that no one wants to be in, but what other choice do you have? With so many financial obligations, how in the world is it possible to finance it all without using debt? How can the average Joe turn the tide financially and stop being a slave to debt?

Well, there are several steps you’ll need to take. I’ll be honest, getting out of debt is not the easiest thing you could ever do. However, the good news is that anyone can do it, and the rewards are definitely worth it!

Here’s a rundown of the most important steps you need to take:

- Change your mindset about using debt

- Get mad and “go naked” (more about that below)

- Use a step-by-step process to get out of debt

- Start building wealth

- Enjoy the freedom of becoming debt free!

You Have to Change Your Mindset

The typical mindset of the American consumer is that debt is inevitable. But here’s the deal: living in bondage is a choice, not an inevitability.

Anyone can get out of debt if they do the right things. The first thing you must do is make a choice to get rid of debt for good. This means changing your mind about car payments, credit cards, and 90 days same-as-cash offers.

It means converting your life over to a cash-only lifestyle where the primary question is “how much does it cost?” instead of “how much is the payment?”

It takes a little time to make that leap, but you can do it!

Get Mad and Go Naked

I recommend that you get mad at your debt. Get so mad at what it’s doing to keep you enslaved that you decide it’s time to overcome your oppressor and gain your freedom! Getting your emotions involved is key to getting out of debt and never going back.

Going Naked

Ok, I know this sounds a little weird. Please keep your clothes on! “Going Naked” simply means that you’re ditching credit for good - you’re going naked with credit!

This is a hard one for most people.

Most of us (me included) want to hang on to that one last credit card while getting out of debt. It feels like a security blanket, but in reality it’s just a sign that you haven’t truly changed your mindset about debt yet.

It’s one of the biggest reasons why so many fail at getting out of debt completely.

It took my wife Angie and I a couple of tries, but we finally got rid of the last credit card over 12 years ago and started using the envelope system. It was the best decision we ever made!

Steps to Get Out of Debt

Once you change your mindset, get mad, and get naked, your work has just begun.

Now you can start the practical steps it takes to get out of debt:

- Start doing a written monthly budget and cash envelope system.

- Implement a debt payoff plan (some call it a debt snowball).

- Once consumer debt is paid off, focus on savings, investments, and paying off the mortgage.

- Start building huge amounts of wealth!

I’ve written an entire series of posts detailing all these steps. You can find the series here.

What Your Life Looks Like Without Debt

The great thing about achieving debt freedom is that it opens a world of possibilities that you didn’t have available before. Here’s a list of some of the great outcomes you can expect:

- You’ll have the freedom to make better life decisions because feeding your debt is not a constant concern.

- Stress levels go way down. You’re not constantly under the gun financially.

- No more car payments - You’ll pay cash for your cars!

- Building wealth accelerates at a more rapid pace.

- You will be more able to be a blessing to others.

Our Personal Experience

I can tell you from personal experience that getting out of debt is everything it’s cracked up to be!

Since Angie and I got out of debt a dozen years ago, we haven’t had a single money fight. We’ve also paid cash for 3 cars, 2 college degrees (3 more currently in progress), a rental property, and watched our savings consistently grow over time.

We have been able to make better life choices based on financial strength instead of desperation. We’ve also been able to give to others on a level that was simply not possible when we were in debt.

The great thing is, you can do this too!

You don’t have to be one of those “normal” people who are in debt up their eyeballs. Using the steps above, you can achieve financial freedom and get more out of your financial life than you ever thought you could.

Over the next weeks and months, you’ll see posts from me here on the Medi-Share blog talking in-depth about some of the concepts I mentioned above. You can also catch me on my own blog, Celebrating Financial Freedom.

See you soon!

Have you found a way to get out of debt? What's your success story?