How much of my monthly income should I save? Should I invest or pay off debt? Which debt should I pay off first? What car loan can I afford? How much should I be investing for retirement? What's my net worth?

These are just some of the critical money questions you may ask yourself as you work to build a solid financial house and plan for the future.

Yet answering these questions can also be confusing and time-consuming, leading you to inaction or making ill-advised financial moves. The good news is that various free online calculators can help you make better financial choices and manage your money.

Financial calculators are tools for assessing various aspects of your finances. The information they provide can help you better understand your current financial situation and make adjustments to help you save more money over time and meet future goals.

In this article, we share examples of eleven distinct types of financial calculators and how you might use them in your financial journey to make informed decisions and help your overall financial planning.

11 Free Online Financial Calculators for Money Management

1. Expense Calculators

To figure out how much you can put toward your savings goals, you must know how much you'll have left after paying bills each month.

If you don't carefully track your expenses, you may underestimate spending categories and overestimate how much money you'll be able to save. This can prevent you from reaching your financial goals.

The Monthly/Yearly Expenses Calculator from the non-profit organization, Take Charge America, helps you analyze your financial needs by itemizing your current living expenses.

To use this calculator, you input monthly or annual expenses in various categories - don't forget non-regular spendings such as medical expenses or gifts. It then calculates the total amount and percentage of your spending for each category. You'll also see the total cost of maintaining your current annual standard of living.

If you'd prefer to personalize your expense tracker further, you can try the Expense Calculator at the Financial Mentor.

You'll input your income for the period you will be entering expenses for (monthly or yearly) and include the name and amount for each expense category. The calculator will total your living expenses and show them as a percentage of your household income.

2. Savings Calculators

You know saving money is important and that you should have an emergency fund for a crisis, sinking funds for expected expenses, and retirement savings for the future.

A financial calculator can help you determine your savings growth over time, estimate how long you'll need to save for specific goals, and more.

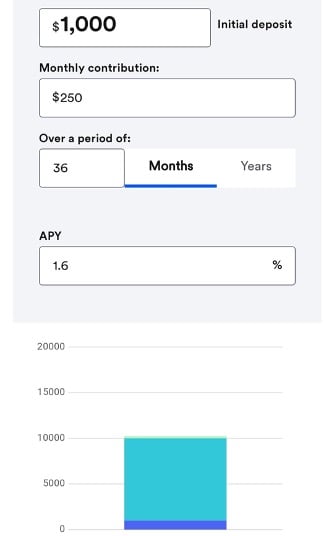

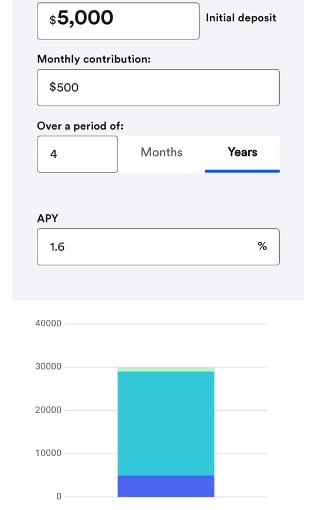

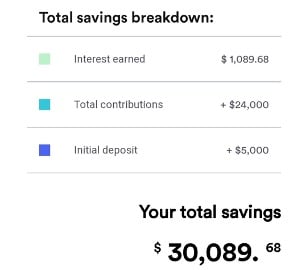

Bankrate's Simple Savings Calculator is easy to use and allows you to change the initial deposit amount, monthly contributions, the time period (in months or years), and annual percentage yield (APY). It uses your inputs to calculate total savings and breaks it down into interest earned, total contributions, and initial deposit.

You could use this tool to figure out how much you'd need to stash away each month to grow your emergency fund to cover 3-6 months of expenses. If you're trying to amass a sizeable down payment for a home, you could use this resource to help you figure out how many years it would take to save that amount.

For example, you may have a basic emergency fund of $1,000 but would prefer a buffer of $10,000 to reduce financial risk. Using this calculator and the current interest rate of an online high-yield savings account at Ally Bank (APY of 1.6%), you'd need to save $250 per month to reach your goal in 36 months.

(Note: The average APY hovers near 0.1% at traditional lenders. Online high-yield savings accounts will generally help you reach your savings goals faster.)

If you have $5,000 saved but have a goal of $30,000 for a down payment on a home, the calculator shows it will take 48 months (4 years) of saving $500 a month with an APY of 1.6% to meet that goal. If you decide you want to reach that goal sooner, the calculator will show you how much more you'll need to put away each month.

Another important savings calculator you should use is the Compound Interest Calculator at Investor.gov. If you think you can wait to put off saving in a retirement plan, this calculator will show you why "investing early and often" (even in small amounts) is crucial for future earnings.

The earlier you start investing, the more you’ll earn as you keep making interest on top of interest over decades. While the goal is to keep adding to your investments during your career, various financial calculations will show the power of compounding - even if you never add more money to the initial investment.

3. Budget Calculator

Armed with information about your expenses and savings, you can consider using a budget calculator to manage your money better.

Calculator.net has a free Budget Calculator you may find helpful. This basic calculator provides a basic template for people who want to start budgeting their personal finances on a month-to-month basis.

After entering your data, you'll quickly see if your budget has discretionary income (money left over) each month or if you are running a deficit budget.

It also calculates your debt-to-income (DTI) ratio, housing costs by gross income, and breaks down your expenses by category, showing them as a percent of your overall income. There are also suggestions in red (i.e., recommend 15% or higher for retirement savings) if your values fall below certain thresholds.

If you're looking for a more advanced tool to help you get your finances in order, consider the budgeting calculators and financial instruments from Mint, Every Dollar, or You Need a Budget.

4. Debt Payoff

If you're like most Americans, there's a good chance you have some type of debt. This could include unsecured types of loans such as spending on credit cards, personal loans, or student loans.

Many people also take on secured debt (that has collateral) such as mortgages and auto loans because it is difficult for most people to pay for a house or car in full at the time of purchase.

When your goal is to pay off debt quickly, there are different strategies you can use. Attacking your unsecured debt first (especially credit card balances and high-interest loans) is what people usually focus on first.

Some people choose to pay off the smallest unsecured debt first (regardless of interest rate) by paying the minimum payments on all other debts and putting any extra money they have toward the lowest balance. Once they eliminate that debt, they "snowball" the monthly payment toward the next smallest debt until all obligations are gone.

The idea behind this strategy is that you may be more motivated to stick to your budget because you can pay off debts more quickly.

Dave Ramsey's Debt Snowball Calculator will show you how fast you can become debt free using this method.

Others put extra money toward their highest interest debt until it's paid off. The "avalanche" approach works well for those who want to save the most money possible on interest and don't need small "wins" to stay focused.

The Debt Payoff Calculator on Caculator.net uses the debt avalanche method. It estimates the amount of time needed to pay back one or more debts and gives users the most cost-efficient payoff sequence, with the option of adding extra payments.

5. Life Insurance Calculator

You need life insurance if anyone depends on your income, you're self-employed, you have a dependent with special needs, and more. But how much life insurance do you need to care for those you leave behind?

Rather than estimating an amount, consider using a life insurance calculator such as the one on the non-profit organization Life Happens website.

You'll be asked questions including:

- How much annual income would you like to provide if you were no longer here?

- How many years should income be provided after you’re gone?

- How much debt would you like to pay off immediately?

- How much would you like to provide for childcare?

- How many children require college funding?

- How much would you like to set aside for an emergency fund?

- How much personal life insurance do you already have?

The calculator then determines your estimated life insurance need and you can download a pdf or email yourself a copy of the results.

6. Retirement Savings Calculators

There are dozens of online retirement savings calculators to choose from that answer a variety of questions you may have about retirement planning through the years.

Vanguard offers a simple tool allowing you to write your retirement "story," and it calculates your retirement income. The information it provides will help you see where you stand in terms of your goals and allows you to see different ways to meet them.

The Retirement Investment Calculator at Financial Mentor figures out how much you need to invest each month to meet your goals by target dates. A separate Retirement Savings Calculator helps you figure out how much time it will take to reach retirement plan savings goals.

AARP also has a Retirement Calculator to help you see how much you need to accumulate for retirement. You'll answer questions about your household status, salary, and current retirement savings.

The tool also allows you to add more detailed information about your finances and choose a retiree lifestyle option to estimate more accurately.

7. Auto Loan and Affordability Calculators

Before you head out to a dealership or search for new (or new-to-you) cars online, give the calculators at Cars.com a try.

With their car affordability calculator, you can use your monthly budget to estimate your maximum car price. The tool allows you to decide how much car you can afford by adjusting the down payment amount, trade-in value, loan term, and annual percentage rate (APR).

You can also estimate monthly car loan payments using the auto loan calculator. You'll enter a car price and adjust other factors such as length of the loan, APR, and sales tax to see how changes affect your estimated payment.

It's easy to become "underwater" on an auto loan. These online tools should help you make a better decision about any car you plan to buy.

8. Mortgage Loan and Affordability Calculators

Zillow offers several different housing calculators you'll find helpful when a new home is in your future.

You can start with the Affordability Calculator to determine just "how much house" really makes sense with your budget. You'll enter your income, down payment amount, and total monthly debts to figure out how much you can spend on a house. An advanced option is also available that allows you to add more details.

You can enter the price of a house and expected down payment into the Mortgage Loan Calculator to get a quick estimate of a total mortgage payment, including principal and interest, plus forecasts for PMI, property taxes, home insurance, and HOA fees.

Becoming "house poor" is a real thing. Buying a home you can comfortably afford will help you meet other important financial goals you've set for the future.

9. College Savings Calculator

If you have children, you may want to plan to help pay for college expenses. T. Rowe Price has two College Savings Calculator options that will help you determine projected college savings based on the information you enter about your child, college options, and financial contributions.

In addition to a basic calculator, the advanced calculator allows you to adjust for more children, rate of return, gifts, and years attending college.

The results will aid you in understanding future college expenses and estimate how much to save to stay on track with your college savings goals.

10. Net Worth Calculator

Your net worth is an essential indicator of how financially secure you are. The basic formula for net worth is assets minus liabilities.

Assets include everything you own, including your home and car. Liabilities include debts owed to banks or other lenders.

To determine your net worth, check out AARP's Net Worth Calculator.

You'll be motivated to continue positive money habits as you watch your net worth grow. But if your net worth is negative, you can make adjustments with calculator tools to determine ways to improve your financial standing.

11. My Social Security Calculator

If you haven't already set up your "My Social Security" account, add that to your "to-do" list. With access to your account, you'll be able to use this financial calculator to estimate your Social Security Retirement Benefits.

Some people believe Social Security won't be around when it comes time for them to retire. But current reserve funds allow for full benefits to be paid until at least 2035. At that point, if reserves are depleted, benefits may be reduced some percentage - but not eliminated.

While you may disregard your Social Security benefit in retirement planning, it is still essential to know how much money you’re entitled to when you reach the age to collect.

Using Financial Calculators to Manage Your Money

Just as a contractor needs tools to effectively and efficiently build a home, consider using these online resources to help you make smarter money moves to help combat inflation and secure your financial future.

Don't mistake estimating your income or monthly expenses when you have to make financial decisions. While it may not make a significant difference in some cases, "guesstimating" may cause you to make choices that could harm your financial health.

Online money calculators can give you information to aid you in understanding where you stand financially. Still, you should also know when to hire financial professionals.

Improving your financial literacy with online resources and helpful tools is important. But making informed money decisions with a professional's guidance may help you reach financial freedom sooner and with much less stress.