Estate planning seems to be one of “those topics.” A topic you hear about and know you should do, but one you keep procrastinating on. We get it. Life is busy, and you get caught up in living it.

While most everyone agrees it’s an important topic, two-thirds of us really don't want to think about what happens to us and our stuff when life comes to an end.

But estate planning is much more than making pre-arrangements for a funeral or deciding who gets what when you pass on.

What is Estate Planning?

An estate plan is a comprehensive strategy to protect you, your loved ones, and your assets throughout your lifetime and upon your death.

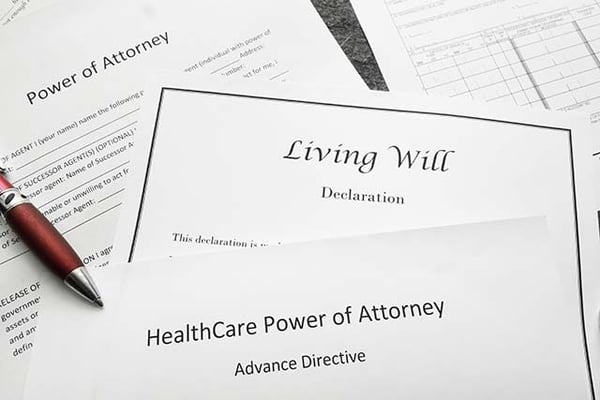

Estate planning is a process and can include creating various documents to distribute money and property when you die, or to manage your affairs upon incapacitation from an accident, illness, or another situation leaving you unable to make or act on decisions for yourself.

Some documents you need now, and others you’ll add in the future based on specific life events or various stages of adulthood.

The process also includes things like financial and income protection planning, asset management and tax planning, and naming guardians for your children or family pets.

To be clear, estate planning is something for almost everyone. You don’t need to have lots of money, be married, or be a parent to start estate planning. Nor must you reach the age of 55 to draft a will or an advance health care directive.

Anyone 18 or older who has people or things they want to protect, needs to prepare at least a few essential documents and begin thinking about their long-term strategy.

Essential Estate Plan Documents Include:

- Advance Care Directives - these legal documents come into play when you’re unable to communicate or make medical decisions for yourself. They explain your preferences for health care, designate a representative to make medical decisions on your behalf, provide instructions for end-of-life care, and present other important medical information and health care wishes you want to be known.

- Financial Power of Attorney - a legal instrument used to give someone the ability to manage your financial affairs when you’re unable to do so yourself.

- Will - a legal record detailing the distribution of your assets to heirs and beneficiaries after you die. A simple will may be all that’s necessary for modest estates when few valuable assets and heirs are involved. For more complex family situations or estates, a last will and testament may be the better choice. Estates with substantial assets and unique family dynamics may also benefit from using a living trust.

Failing to draft these legal documents puts decisions about your medical care, finances, and property in the hands of the court upon your incapacitation or death. That means your final wishes for life-sustaining measures, guardianship of children, or the distribution of assets may not be known or followed.

While estate planning may not be at the top of your to-do list right now, there’s a good chance you should move it up and take some immediate steps to complete the documents above. Then you can do some additional research to craft a more comprehensive game plan to meet any further needs specific to your situation.

Start Your Estate Plan Now in These 10 Steps

1. Create goals

One of the primary purposes of estate planning is determining how your assets are divided when you die. This allows you to protect and provide for your spouse, minor children, or other loved ones or charities important to you. But you need to protect yourself and those that depend on you while you’re alive too.

Begin with listing the objectives of your estate plan. Possible goals to include are:

- Protecting your income from a disability or an early death

- Providing for a stay-at-home spouse, minor children, or a member with special needs

- Saving for retirement or paying college tuition for the kids or grandkids

- Naming a guardian for minor children or a personal representative or agent to manage your estate when you cannot

- Leaving specific financial gifts, property, or heirlooms to certain relatives or friends

- Donating to your church or other charitable organization

- Maintaining privacy, generation wealth, or a family business

- Minimizing taxes and potential conflict

Your goals are personal but should be created in tandem with your spouse if married. Also, consider discussing your plans with adult children or other family members as appropriate.

2. Get organized

Your “estate” is everything you own, minus any debts you owe. If you don’t already track your net worth, start with creating a list of your assets (the things you own) and a list of your liabilities (the money you owe).

Your asset list should include a description and the current market value of your property. These could be bank accounts, retirement savings accounts, stocks and bonds, real estate, vehicles, and insurance policies. Be sure to note if you own the property as an individual or jointly with a spouse or another person.

You’ll also want to detail any outstanding liabilities. Include mortgages, car loans, personal loans, credit cards, and any other debts you owe.

Taking some time to list specific valuable household and personal items, as well as any heirlooms you want to gift, will also be beneficial. You don’t need to inventory each item right now but should include your most valuable possessions and any pieces you want to give to a particular individual.

You’ll save time later if you create a list of heirs and beneficiaries, too.

An “heir” is someone with a legal right to your property upon your death, such as a spouse, children, or other family descendants. A “beneficiary” is someone you legally designate as having a right to property or assets you leave behind at death.

While heirs can be beneficiaries, a beneficiary isn’t always an heir.

3. Establish basic protections

Protecting yourself and your loved ones likely involves needing to protect your income.

An emergency fund can provide a safety net in the event of a job loss or business closing. Experts recommend saving 6-9 months or more of expenses for an emergency fund.

Disability insurance can help cover short or long-term income loss due to an injury or illness, keeping you from working. Life insurance proceeds can serve as an income substitute for years depending on the policy amount.

If you currently hold disability and term life insurance, check your policy details to ensure they still meet your needs.

If you do not have policies or want to add additional protection, you can secure term life insurance through online providers such as Bestow, Haven Life, or Ladder.

For a disability program, look into insurance providers such as Breeze, Guardian, and The Standard.

The other basic protections you need to get in place are your advance care directives, financial power of attorney, and a will.

You can create advance care directives without the need for an attorney, but do your homework and be extremely cautious before completing any other estate planning documents online or with a template form in a book.

The following steps are to help you prepare for drafting them.

4. Designate beneficiaries and decide on gifts

The work you did to get organized pays off here. Now, review all your assets and determine how you want them divided between your heirs and beneficiaries.

Consider the current financial needs of your beneficiaries and their long-term needs as well. For example, you may want to pay college tuition costs for your children and grandchildren or detail what happens to assets if your spouse were to remarry if you suffered an early death.

It’s crucial to ensure the people you want to receive life insurance policy proceeds, retirement account funds, or other financial account assets are listed as the beneficiary on those specific items. If you don't, those assets become a part of your overall estate and may end up in the hands of someone you didn’t intend.

With that being said, designated beneficiaries trump what’s written in your will. If something changes and you no longer want a named beneficiary to receive assets, you must remove them and name a new beneficiary with the insurance provider or financial institution. Listing the details in your will isn’t always enough for some assets - be sure to coordinate it with your financial and insurance companies.

5. Determine a personal representative (executor)

You’ll need to name a personal representative in your will. Also known as an executor, this person handles your estate upon your passing. They’ll manage your legal affairs and finances, including paying bills, outstanding debts, and distributing your assets.

This can be a demanding and time-consuming role, so your chosen representative should be responsible, patient, trustworthy, and willing to assume the role of carrying out your final matters.

6. Name guardians and trustees for kids

Naming someone in your will to assume guardianship of your minor children should you die is a must. Otherwise, if there’s no surviving parent, the court decides who steps into that role.

While the court may name a close family member, it may not be the person you’d choose to raise your kids. This decision is one you should make now, instead of someone else being forced to choose for you under terrible circumstances.

When leaving financial assets behind for kids, you’ll also need to name someone to manage them on your children’s behalf until they become legal adults. This could be the same individual that is their guardian, but it does not have to be.

Pick the person or persons you feel are best suited for each role and who’s willing to assume the responsibility.

7. Consider a revocable living trust

Trusts can be excellent estate planning tools to help avoid the probate process, maintain privacy, and have your assets pass more quickly to heirs. Some can even help you minimize or avoid estate taxes.

There are many types of trusts, but the most common is a living trust, specifically a revocable living trust. It’s essentially a legal instrument that places your assets ‘in trust’ for your benefit while you’re alive and details what happens to them when you die. The revocable part means you can cancel or change it at any time while you’re living and mentally competent.

Trusts are a large and complex topic deserving more than a few brief paragraphs. They’re not right for everyone, but those with minor children, a blended family, substantial assets, a business, or other involved circumstances that may put them in need of more than a simple will should research living trusts further.

8. Balance protections for today and tomorrow (& beyond)

When doing any type of planning, it’s essential to think of the big picture as you work on the smaller details. This is especially true with financial and estate planning. You must take care of yourself first, as well as your spouse, before you can take care of anyone else. But focusing too narrowly today may keep you from building and protecting your estate for tomorrow.

Take time to think through different scenarios to help ensure the moves you make will protect you and your loved ones now and in the future. Paying college tuition for future grandchildren is an admirable goal. But it’s not the right move if it leaves you or your spouse without adequate funds throughout your lifetimes.

9. Put your plan in writing

If you have a fairly straightforward estate and an uncomplicated family situation, you may decide to tackle most of your estate plan on your own. There are plenty of online document services to use, including Legalzoom.com, RocketLawyer.com, Nolo.com, Lawdepot.com, and TrustandWill.com.

While “DIY-ing” your estate documents may save you time and money, it isn’t the right move for many people. Your circumstances may be more complicated than you realize when you start working on your plan.

Hiring an estate planning attorney may save you more money in the long run because of their expertise with various provisions and tools, and their understanding of what’s allowed under state law.

Some lawyers charge flat fees for estate planning, but you may be able to save time and money if they charge an hourly rate. You can accomplish this by thinking about the different parts of your plan and recording information you want to include, along with questions and concerns as you work through these steps.

10. Keep going

As previously mentioned, estate planning is a process. You’ll need to add or make changes to estate plan documents through various life stages and events. Start with at least the essentials - a will, power of attorney, and advance care directives. Then keep learning, reviewing, and managing your plan as you build and enjoy your estate.

Thinking and talking about death and incapacitation is emotional for many people. But it’s essential to start the process. Your loved ones may be relieved to learn you’ve taken these steps and have a plan in place. It may even encourage them to begin thinking about their estate plan too.

Take steps today to protect yourself and your loved ones

Having protection in place to take care of those you love and ensure your wishes will be carried out when you’re no longer here is priceless. Start giving yourself and your family that gift today.